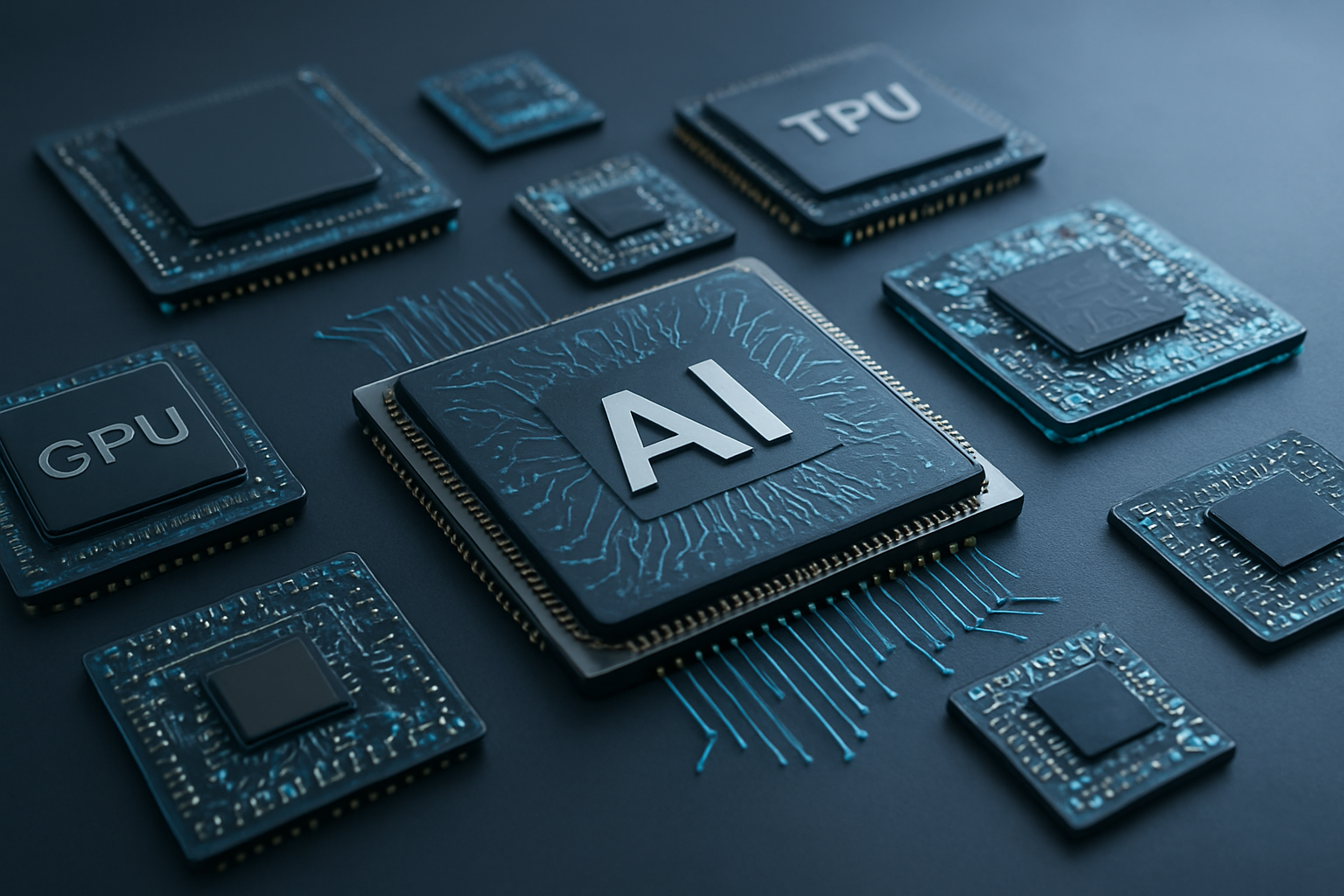

The AI chip wars 2024 are reshaping how we think about processing power, with NVIDIA vs AMD GPU battles heating up while Google TPU vs GPU comparisons reveal new possibilities for machine learning processors. This comprehensive AI chip comparison breaks down the strategies, strengths, and real-world performance of today’s leading AI accelerators.

This guide is for tech professionals, data scientists, and business leaders who need to understand which AI hardware best fits their machine learning workloads and budgets. You’ll also find value here if you’re tracking the AI chip market analysis for investment decisions or staying current with custom AI silicon developments.

We’ll explore NVIDIA’s dominant position in the GPU performance comparison space and how their CUDA ecosystem keeps competitors at bay. You’ll discover AMD’s aggressive pricing strategy and architectural innovations that challenge GPU supremacy. Finally, we’ll examine Google’s TPU approach and the emerging quantum computing chips race that could change everything about AI accelerator benchmarks in the coming years.

Understanding the Current AI Chip Landscape

Market Dominance and Revenue Breakdown Across Major Players

The AI chip comparison landscape reveals a fascinating three-way battle that’s reshaping the semiconductor industry. NVIDIA sits atop the throne with an estimated 80% market share in AI accelerators, generating over $60 billion in data center revenue in fiscal 2024. Their dominance stems from early investments in CUDA software ecosystem and strategic partnerships with cloud giants.

AMD trails significantly but has been gaining ground with their Instinct MI300 series, capturing roughly 5-10% of the AI chip market. Their revenue from data center GPUs reached $2.3 billion in 2023, representing substantial year-over-year growth despite starting from a smaller base. Google takes a different approach entirely, developing custom TPUs primarily for internal use across their vast cloud infrastructure, though they’ve begun offering these processors to external customers through Google Cloud Platform.

The quantum computing chips segment remains nascent but promising, with investments exceeding $25 billion globally. IBM, Google, and startups like Rigetti compete in this space, though commercial viability remains years away. Traditional metrics don’t apply here, as quantum processors solve fundamentally different problems than classical AI workloads.

Revenue distribution shows NVIDIA’s overwhelming advantage in traditional GPU sales, while Google’s TPU strategy focuses on operational efficiency rather than direct hardware sales. AMD’s aggressive pricing and open-source software initiatives aim to disrupt NVIDIA’s ecosystem lock-in.

Key Performance Metrics That Define Chip Superiority

GPU performance comparison centers around several critical benchmarks that determine real-world AI capabilities. Raw computational throughput, measured in teraFLOPS (trillion floating-point operations per second), provides the foundation for AI accelerator benchmarks. NVIDIA’s H100 delivers up to 989 teraFLOPS for AI training workloads, while AMD’s MI300X achieves approximately 1,300 teraFLOPS under optimal conditions.

Memory bandwidth and capacity create equally important bottlenecks. Modern AI models require massive amounts of high-speed memory to store parameters and intermediate calculations. The H100 includes 80GB of HBM3 memory with 3TB/s bandwidth, compared to AMD’s MI300X offering 192GB HBM3 with 5.3TB/s bandwidth. These specifications directly impact training times for large language models and computer vision applications.

Power efficiency increasingly drives purchasing decisions, especially for large-scale deployments. Machine learning processors must balance peak performance with thermal design power (TDP) ratings. Google’s TPU v5e achieves superior performance-per-watt for inference workloads, while traditional GPUs excel in training versatility.

Interconnect technologies like NVIDIA’s NVLink, AMD’s Infinity Fabric, and Google’s custom networking enable multi-chip scaling. These connections determine how effectively processors can work together on distributed AI workloads, making them crucial for enterprise and research applications requiring massive computational resources.

Applications Driving Demand for Specialized AI Hardware

Large language model training represents the most demanding application category, requiring thousands of GPUs working in parallel for months. ChatGPT, GPT-4, and similar models consume enormous computational resources, driving hyperscale cloud providers to invest billions in custom AI silicon. These workloads favor processors with high memory bandwidth and efficient tensor operations.

Computer vision and autonomous vehicle development create different performance requirements. Real-time object detection, image segmentation, and sensor fusion demand low-latency inference capabilities rather than raw training power. Edge AI applications in smartphones, security cameras, and IoT devices prioritize power efficiency and compact form factors over peak performance.

Scientific computing applications like protein folding, climate modeling, and pharmaceutical discovery benefit from diverse AI accelerator architectures. Quantum computing chips show particular promise for optimization problems and cryptographic applications, though current systems remain experimental.

Gaming and content creation markets increasingly overlap with AI chip wars 2024 trends. Real-time ray tracing, AI-upscaling, and procedural content generation require specialized hardware features. NVIDIA’s RTX series integrates AI acceleration into consumer graphics cards, while AMD’s RDNA architecture focuses on traditional rasterization performance with some AI capabilities.

Financial services, healthcare imaging, and natural language processing each present unique computational profiles that influence AI chip market analysis. These diverse applications explain why multiple companies can compete successfully by targeting specific use cases rather than attempting universal solutions.

NVIDIA’s GPU Powerhouse Strategy

Architecture Advantages of H100 and A100 Data Center GPUs

NVIDIA’s Hopper H100 and Ampere A100 GPUs represent the pinnacle of AI chip engineering, delivering unprecedented computational power for machine learning workloads. The H100’s Transformer Engine specifically targets modern AI models, featuring fourth-generation Tensor Cores that accelerate FP8 precision calculations by up to 6x compared to previous generations. This architectural innovation directly addresses the massive computational demands of large language models and transformer-based AI systems.

The A100’s multi-instance GPU (MIG) technology allows data centers to partition a single GPU into up to seven isolated instances, maximizing resource utilization across different AI workloads. With 40GB or 80GB of high-bandwidth memory (HBM2e), these chips handle massive datasets without memory bottlenecks. The H100 pushes boundaries even further with 80GB of HBM3 memory and memory bandwidth reaching 3TB/s.

Both architectures feature NVLink interconnects that enable seamless multi-GPU scaling, crucial for training the largest AI models. The H100’s NVLink 4.0 delivers 900GB/s of bidirectional bandwidth, allowing researchers to build supercomputer-scale AI training clusters with minimal performance loss between GPUs.

CUDA Ecosystem Lock-in and Developer Adoption Benefits

NVIDIA’s CUDA platform creates a powerful moat around their GPU business, with over 4 million developers worldwide building AI applications using CUDA tools. This ecosystem advantage becomes particularly evident in AI chip comparison discussions, as switching from CUDA to alternative platforms requires significant code rewrites and retraining.

The CUDA Deep Neural Network library (cuDNN) provides optimized primitives for deep learning frameworks like PyTorch and TensorFlow. Popular AI frameworks naturally default to CUDA implementations, making NVIDIA GPUs the path of least resistance for AI developers. This software ecosystem lock-in extends beyond just libraries to include:

- Development Tools: Nsight profiling tools, Triton Inference Server, and TensorRT optimization

- Pre-trained Models: Thousands of AI models optimized specifically for NVIDIA hardware

- Cloud Integration: Seamless deployment across AWS, Google Cloud, and Azure GPU instances

- Educational Resources: Extensive documentation, tutorials, and certification programs

The network effects of CUDA adoption create a self-reinforcing cycle where more developers choose NVIDIA, leading to better software optimization, which attracts even more developers.

Gaming GPU Crossover Success in AI Workloads

NVIDIA’s consumer gaming GPUs have found unexpected success in AI applications, creating a unique crossover market that competitors struggle to match. The RTX 4090, originally designed for gaming enthusiasts, delivers impressive AI training performance at a fraction of data center GPU costs. Many researchers and startups leverage gaming GPUs for early-stage AI development before scaling to enterprise hardware.

The RTX series’ RT cores, initially designed for ray tracing in games, provide additional parallel processing capabilities that benefit certain AI workloads. DLSS technology development has also contributed to AI advancement, as the neural networks powering game upscaling share architectural similarities with other computer vision models.

This gaming-to-AI pipeline creates multiple touchpoints with developers and establishes NVIDIA’s brand presence across different market segments. Students learning AI often start with consumer GPUs, building familiarity with NVIDIA’s ecosystem before entering professional environments where they influence enterprise purchasing decisions.

Supply Chain Challenges and Production Capacity Limitations

NVIDIA’s dominant position in AI chip wars 2024 faces significant constraints from manufacturing bottlenecks and geopolitical tensions. The company relies heavily on TSMC’s advanced 4nm and 5nm process nodes, creating vulnerability when demand spikes for AI accelerators surge beyond production capacity.

Current lead times for H100 GPUs stretch 3-6 months, with some enterprise customers waiting even longer for large orders. This scarcity has created a secondary market where H100s command premium prices, sometimes 2-3x above list price. The situation echoes the cryptocurrency mining boom but with more sustained demand from AI companies.

Export restrictions to China have complicated NVIDIA’s supply chain strategy, forcing the development of modified chips like the H800 that comply with regulations while still serving international markets. These restrictions also push Chinese companies toward developing domestic alternatives, potentially reducing long-term demand for NVIDIA products.

Manufacturing complexity increases with each generation, as the H100 requires cutting-edge packaging technology and advanced cooling solutions. TSMC’s capacity constraints mean NVIDIA must carefully balance allocation between data center GPUs, gaming products, and automotive chips, creating tough strategic decisions about market prioritization.

AMD’s Challenge to GPU Supremacy

MI300X and RDNA architecture competitive positioning

AMD has stepped up its game dramatically with the MI300X series, marking a serious challenge to NVIDIA’s dominance in AI chip comparison discussions. The MI300X represents AMD’s most aggressive push into high-performance computing, featuring their advanced RDNA architecture that packs impressive computational density. This chip integrates both CPU and GPU elements on a single package, delivering 192GB of HBM3 memory – significantly more than competing solutions.

The architecture brings several key advantages to the table:

- Unified Memory Architecture: Eliminates data transfer bottlenecks between CPU and GPU

- Advanced Packaging Technology: 3D stacking enables higher transistor density

- Memory Bandwidth: Exceptional 5.2 TB/s memory bandwidth outpaces many alternatives

- Power Efficiency: Optimized power consumption for data center deployments

AMD’s positioning strategy focuses heavily on memory-intensive workloads where their larger memory capacity shines. Large language models and complex AI training scenarios benefit substantially from the MI300X’s memory advantages, making it particularly attractive for enterprises running memory-hungry applications.

Cost-effectiveness advantages over NVIDIA alternatives

The NVIDIA vs AMD GPU battle has intensified significantly around pricing strategies. AMD consistently undercuts NVIDIA’s premium pricing model, offering compelling total cost of ownership propositions. The MI300X series typically costs 20-30% less than comparable NVIDIA solutions while delivering competitive performance metrics.

Key cost advantages include:

- Lower Initial Investment: Reduced upfront hardware costs for equivalent computational power

- Memory Value Proposition: More memory per dollar spent compared to NVIDIA offerings

- Reduced Infrastructure Requirements: Fewer cards needed for memory-intensive workloads

- Energy Efficiency: Lower power consumption translates to reduced operational costs

Enterprise customers have noticed significant budget savings when deploying AMD solutions at scale. Major cloud providers have started integrating AMD chips into their offerings, validating the cost-effectiveness argument. The price-performance ratio becomes particularly attractive for organizations running inference workloads or training smaller models where NVIDIA’s premium features aren’t essential.

ROCm software platform development and adoption hurdles

AMD’s ROCm (Radeon Open Compute) platform represents both their greatest opportunity and biggest challenge in the AI chip wars 2024 landscape. While the hardware capabilities are impressive, software ecosystem maturity remains a significant hurdle for widespread adoption.

Current ROCm strengths:

- Open-source foundation: Provides transparency and customization opportunities

- CUDA compatibility layer: HIP allows porting of existing CUDA applications

- Growing library support: Expanding support for popular AI frameworks

- Active development: Regular updates and community contributions

However, adoption challenges persist:

- Framework Integration: Many popular AI frameworks still prioritize CUDA optimization

- Developer Familiarity: Most AI developers have extensive CUDA experience

- Debugging Tools: Less mature debugging and profiling toolsets compared to NVIDIA’s ecosystem

- Community Size: Smaller developer community means fewer resources and tutorials

Major AI companies have started investing in ROCm development, recognizing the importance of avoiding vendor lock-in. PyTorch and TensorFlow support continues improving, though optimization levels still lag behind CUDA implementations. The open-source nature appeals to organizations prioritizing software freedom, but the learning curve remains steep for teams transitioning from NVIDIA platforms.

Google’s TPU Innovation and Custom Silicon Approach

Tensor Processing Unit Design Philosophy and Efficiency Gains

Google’s TPU (Tensor Processing Unit) represents a fundamental shift in AI chip design, prioritizing specialized matrix operations over general-purpose computing. Unlike traditional GPUs that handle diverse workloads, TPUs focus exclusively on the mathematical operations that power machine learning models. This custom AI silicon approach delivers remarkable efficiency gains through reduced precision arithmetic and optimized data flow patterns.

The architectural brilliance lies in TPUs’ systolic array design, which processes massive amounts of data in lockstep without the overhead of complex instruction sets. This streamlined approach allows TPUs to achieve superior performance per watt compared to conventional processors. Google’s fourth-generation TPU v4 pods can deliver up to 1.1 exaflops of peak performance while maintaining energy efficiency that traditional GPUs struggle to match.

TPUs excel particularly in inference workloads where consistent, predictable performance matters more than peak throughput. The specialized design eliminates many bottlenecks that plague general-purpose chips, resulting in faster model training times and lower operational costs for large-scale AI deployments.

Cloud TPU Accessibility and Pricing Advantages

Google Cloud’s TPU offering democratizes access to cutting-edge AI acceleration through flexible pricing models that often undercut traditional GPU alternatives. The preemptible TPU instances provide significant cost savings for batch processing workloads, making advanced AI capabilities accessible to smaller organizations and researchers.

The pricing structure reflects Google’s strategic positioning in the AI chip wars 2024, offering competitive rates for both on-demand and committed use scenarios. Cloud TPU pods scale seamlessly from single chips to massive multi-chip configurations, allowing users to match computing resources precisely to their workload requirements without over-provisioning.

Google’s integrated billing and resource management simplifies cost tracking compared to complex GPU cluster deployments. The pay-as-you-go model eliminates upfront hardware investments while providing predictable pricing for long-running training jobs.

TensorFlow Integration Benefits for Machine Learning Workflows

The tight coupling between TPUs and TensorFlow creates an optimized ecosystem for machine learning development. Native TPU support in TensorFlow eliminates compatibility headaches and provides automatic optimization for tensor operations. This seamless integration allows developers to leverage TPU acceleration with minimal code changes.

TensorFlow’s XLA (Accelerated Linear Algebra) compiler automatically optimizes computation graphs for TPU execution, often delivering performance improvements without manual tuning. The ecosystem includes specialized libraries like JAX and Flax that further enhance TPU utilization for research applications.

High-level APIs like tf.distribute.Strategy make multi-TPU training straightforward, abstracting away the complexity of distributed computing. This developer-friendly approach accelerates the machine learning development cycle compared to more complex multi-GPU setups.

Limited Ecosystem Compared to General-Purpose GPU Solutions

Despite their technical advantages, TPUs face ecosystem limitations that restrict their broader adoption. The NVIDIA CUDA ecosystem’s maturity and extensive library support create significant switching costs for organizations invested in GPU-based workflows. Popular frameworks like PyTorch require additional effort to achieve optimal TPU performance, creating friction for developers.

Third-party tool support remains sparse compared to the rich GPU performance comparison landscape. Many specialized AI libraries and research tools prioritize NVIDIA GPU compatibility, leaving TPU users with fewer options for cutting-edge techniques and experimental approaches.

The hardware availability constraints also limit TPU adoption. Unlike GPUs available from multiple vendors and cloud providers, TPUs remain exclusive to Google Cloud Platform, creating vendor lock-in concerns for enterprise customers seeking multi-cloud strategies.

Quantum Computing Race and Future Implications

IBM, Google, and emerging quantum processor capabilities

IBM leads the quantum processor race with their latest Condor chip featuring 1,121 qubits, while their Flamingo processor demonstrates significant error reduction capabilities. Google’s Sycamore processor achieved quantum supremacy in 2019, completing calculations in 200 seconds that would take classical supercomputers thousands of years. Both companies continue pushing qubit counts higher while addressing the critical challenge of quantum error correction.

Emerging players like IonQ, Rigetti, and Atom Computing bring different approaches to the quantum computing chips market. IonQ focuses on trapped-ion technology offering longer coherence times, while Rigetti develops superconducting quantum processors integrated with classical computing systems. These diverse technological approaches create a competitive landscape similar to the current AI chip wars between NVIDIA, AMD, and Google’s custom silicon.

Quantum processors face unique challenges that traditional AI accelerators don’t encounter. Qubits require near-absolute-zero temperatures and extreme isolation from environmental interference. Current quantum systems need massive cooling infrastructure and complex control systems, making them fundamentally different from GPU or TPU deployments.

Hybrid quantum-classical computing potential applications

Quantum-classical hybrid systems represent the most promising near-term approach for AI applications. These architectures combine quantum processors for specific computational tasks with classical AI chips handling data preprocessing and post-processing. Machine learning algorithms can leverage quantum speedups for optimization problems while relying on proven GPU and TPU performance for neural network training.

Drug discovery emerges as a prime candidate for hybrid quantum-classical AI systems. Quantum processors excel at simulating molecular interactions, while classical AI accelerators handle pattern recognition in chemical databases and protein folding predictions. Pharmaceutical companies already invest heavily in both quantum computing research and traditional AI infrastructure to tackle these challenges.

Financial modeling represents another application area where quantum computing chips could revolutionize AI workloads. Portfolio optimization, risk analysis, and fraud detection algorithms could benefit from quantum speedups in specific mathematical operations while leveraging existing GPU-accelerated neural networks for data analysis and pattern recognition.

Timeline predictions for quantum advantage in AI tasks

Industry experts predict limited quantum advantage for specific AI tasks within 5-7 years, primarily in optimization and sampling problems. Companies like IBM target 2030 for fault-tolerant quantum computers capable of solving problems beyond classical capabilities. However, widespread quantum advantage in general AI applications likely remains 10-15 years away.

Near-term quantum advantage will likely emerge in niche applications rather than broad AI workloads currently dominated by GPU and TPU architectures. Quantum machine learning algorithms show promise for certain classification problems and generative models, but they won’t replace traditional AI chip performance comparison metrics anytime soon.

The timeline heavily depends on breakthrough developments in quantum error correction and qubit stability. Current quantum processors lose coherence within microseconds, limiting their practical application in AI tasks that require sustained computation periods.

Investment requirements and technical barriers to overcome

Building competitive quantum computing infrastructure requires massive capital investments exceeding traditional AI chip development costs. Quantum systems demand specialized facilities, cryogenic cooling systems, and precision control electronics that cost millions of dollars per installation. These requirements dwarf the infrastructure costs associated with GPU or TPU deployments.

Technical barriers include quantum error rates that remain orders of magnitude higher than classical computing systems. While NVIDIA and AMD GPUs deliver reliable performance at scale, quantum processors struggle with decoherence, crosstalk between qubits, and limited gate fidelity. Achieving fault-tolerant quantum computation requires error correction schemes that consume thousands of physical qubits to create single logical qubits.

Talent acquisition presents another significant challenge in the quantum computing race. The specialized knowledge required for quantum algorithm development, hardware engineering, and system integration creates fierce competition for qualified personnel. Unlike the established GPU programming ecosystem with CUDA and ROCm, quantum development lacks standardized tools and widespread expertise, slowing practical adoption in AI applications.

Performance Benchmarks and Real-World Applications

Training Large Language Models Efficiency Comparisons

When training massive language models like GPT-4 or Claude, the choice of hardware can make or break your budget and timeline. NVIDIA’s H100 GPUs currently dominate this space, delivering exceptional performance for transformer architectures with their specialized Tensor Cores. A single H100 can process training workloads 6x faster than its predecessor, the A100, while consuming roughly the same power.

AMD’s MI300X series presents a compelling alternative, offering 192GB of HBM3 memory compared to NVIDIA’s 80GB on the H100. This massive memory advantage becomes crucial when training models with billions of parameters, as you can fit larger batch sizes without splitting across multiple GPUs. Early benchmarks show the MI300X matching or exceeding H100 performance on certain LLM training tasks, particularly those requiring extensive memory bandwidth.

Google’s TPU v5p takes a different approach entirely. These custom chips excel at matrix operations fundamental to neural networks, delivering up to 459 teraFLOPS of bfloat16 performance. While TPUs require specific optimizations and work best with Google’s software stack, research teams report 20-30% faster training times compared to equivalent GPU clusters for certain model architectures.

Inference Speed and Energy Consumption Analysis

Real-world inference performance tells a different story than raw computational power. NVIDIA’s GPU performance comparison shows the H100 delivering impressive throughput for chat applications and real-time AI services, but energy consumption remains a critical concern for large-scale deployments.

Google TPU vs GPU analysis reveals significant advantages for inference workloads. TPU v4 pods consume roughly 2.3x less energy per inference compared to equivalent GPU clusters while maintaining comparable latency. This efficiency stems from TPUs’ optimized dataflow architecture, which eliminates much of the overhead present in general-purpose GPUs.

AMD’s RDNA 3 architecture shows promise for edge inference scenarios, where power efficiency matters more than absolute performance. The latest Radeon cards deliver competitive AI accelerator benchmarks while drawing 15-20% less power than comparable NVIDIA solutions. For companies running inference at scale, this energy difference translates to substantial operational savings.

NVIDIA vs AMD GPU battles extend beyond raw performance metrics. Memory bandwidth, driver optimization, and ecosystem support all impact real-world deployment success. NVIDIA’s CUDA ecosystem remains more mature, but AMD’s ROCm platform is rapidly closing the gap with improved compiler optimization and broader framework support.

Cost Per Computation Metrics Across Different Workloads

Breaking down cost-effectiveness across various AI workloads reveals surprising winners depending on your specific use case. Cloud pricing for H100 instances typically runs $2-4 per hour, making them expensive for extended training runs but potentially cost-effective for time-sensitive projects where faster completion offsets higher hourly rates.

AMD’s MI300X offers better value for memory-intensive workloads, with some cloud providers pricing these instances 20-30% below equivalent NVIDIA offerings. The larger memory capacity means fewer multi-GPU setups, reducing communication overhead and total system costs.

Google’s TPU pricing through Cloud Platform presents the most competitive option for specific workloads. Training a mid-size language model on TPU v4 pods costs roughly 40% less than equivalent GPU time, though this advantage diminishes for workloads that don’t map efficiently to TPU architectures.

Custom AI silicon from each vendor targets different price points and performance profiles. NVIDIA’s upcoming B100 chips promise 2.5x performance improvements over H100, but early pricing suggests premium costs that may not justify the upgrade for all applications. AMD focuses on undercutting NVIDIA pricing while delivering comparable performance, making their chips attractive for cost-conscious deployments.

Edge inference applications show the most dramatic cost variations. Purpose-built inference chips from Google and specialized NVIDIA cards deliver orders of magnitude better performance-per-dollar compared to high-end training GPUs when deployed for specific inference tasks.

The battle for AI chip supremacy is reshaping the entire tech industry, with each major player bringing distinct advantages to the table. NVIDIA continues to dominate with its GPU ecosystem and software stack, while AMD is aggressively challenging this leadership with competitive pricing and innovative architectures. Google’s TPU approach shows how custom silicon can deliver exceptional performance for specific AI workloads, proving that one-size-fits-all solutions aren’t always the answer.

Looking ahead, quantum computing promises to completely change the game, though we’re still years away from practical applications. Right now, the choice between these technologies depends on your specific needs – NVIDIA for versatility and ecosystem support, AMD for cost-effective alternatives, and Google’s TPUs for specialized cloud-based AI tasks. The real winners will be those who can adapt quickly as this rapidly evolving landscape continues to surprise us with breakthrough innovations and unexpected partnerships.